New Ross RFC

- …

New Ross RFC

- …

Development 300 Club

Please join us in supporting New Ross RFC by participating in our 300 Club fundraising initiative. We are looking for 300 participants to contribute €30 per month for three years. Your contribution will help fund new (fully inclusive and accessible) female dressing rooms, member’s gym and an all-weather pitch development.

How To Contribute

We want to make it as easy as possible for you to contribute. There are two main ways to do this:

Monthly Payment Option

Click on the button below to access our monthly payment facility on ClubForce.

This is a monthly payment of €30 per month for three years. Alternatively, you can choose to contribute €40 or €50 per month if you wish to provide additional support. Payment will be automatically made using your selected payment method.

Lump Sum Payment Option

A single, up front, lump payment may be more amenable to some members and would definitely help us to build the fund earlier (which might help us with any other finance options that need to be used).

For this option, we’re looking for a lump sum contribution of €1000 (less than the €1080 three year total value).

If you’d like to progress with a lump sum payment or to discuss any other payment options/schedule then please contact our 300 Club Manager, Tommy McLoughlin on 300@nrrfc.ie for further information.

If you have any problems when using the ClubForce site please contact us for help. Or have a look at these instructions.

If a contribution via a business or other commercial route would be more suitable then please contact us to look at what the best option might be.

Recognising Your Contribution

We realise that this is a lot of money to be asking anybody to contribute. We want to recognise the contribution that every single 300 Club member makes, regardless of how, when and how much they contribute.

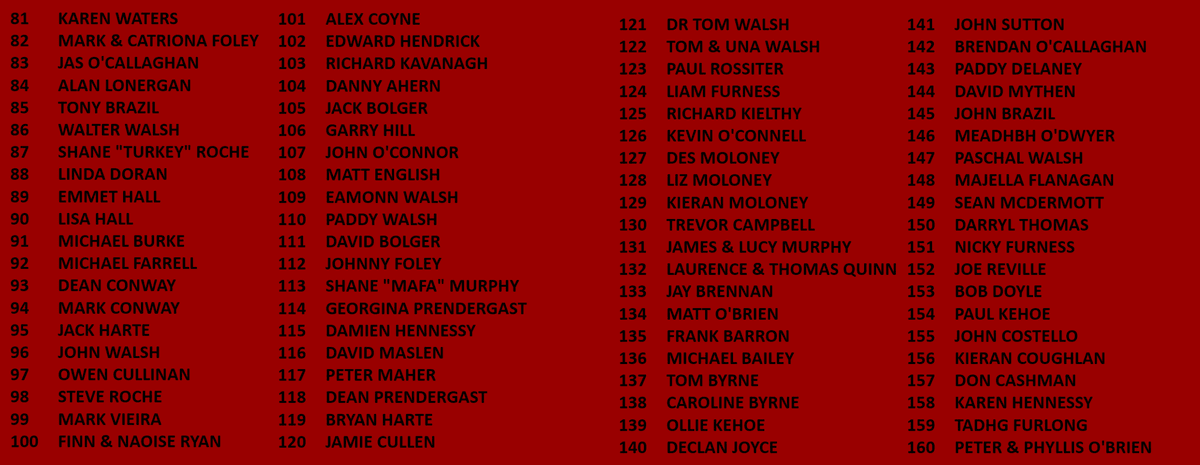

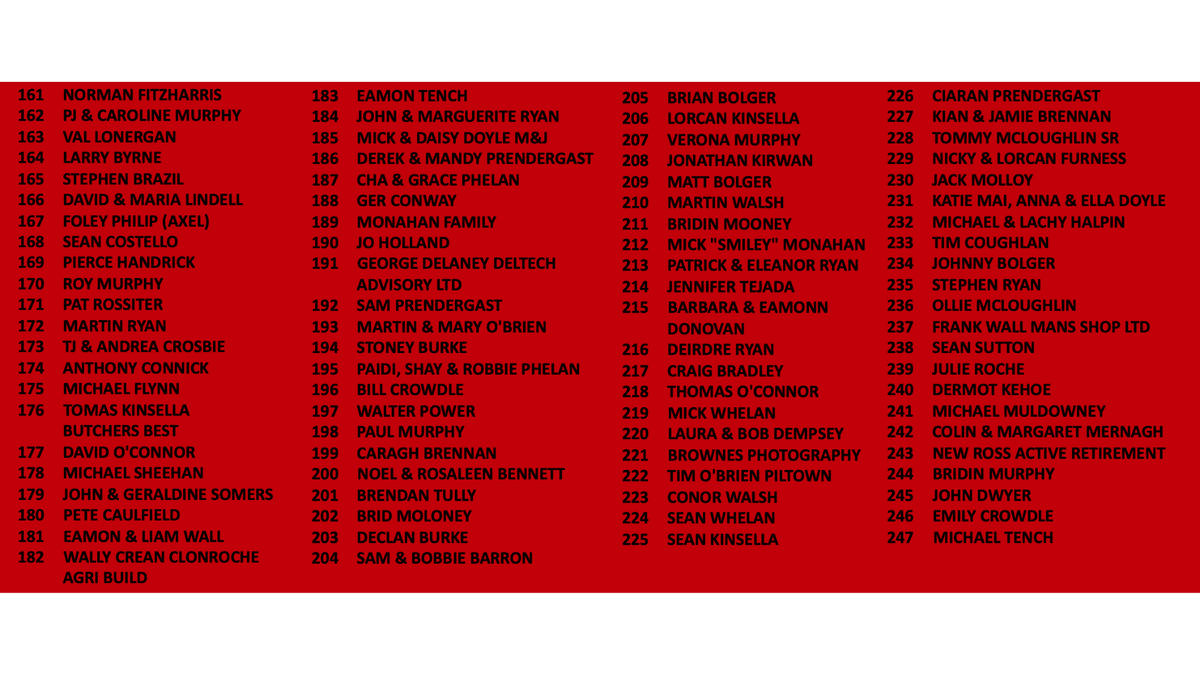

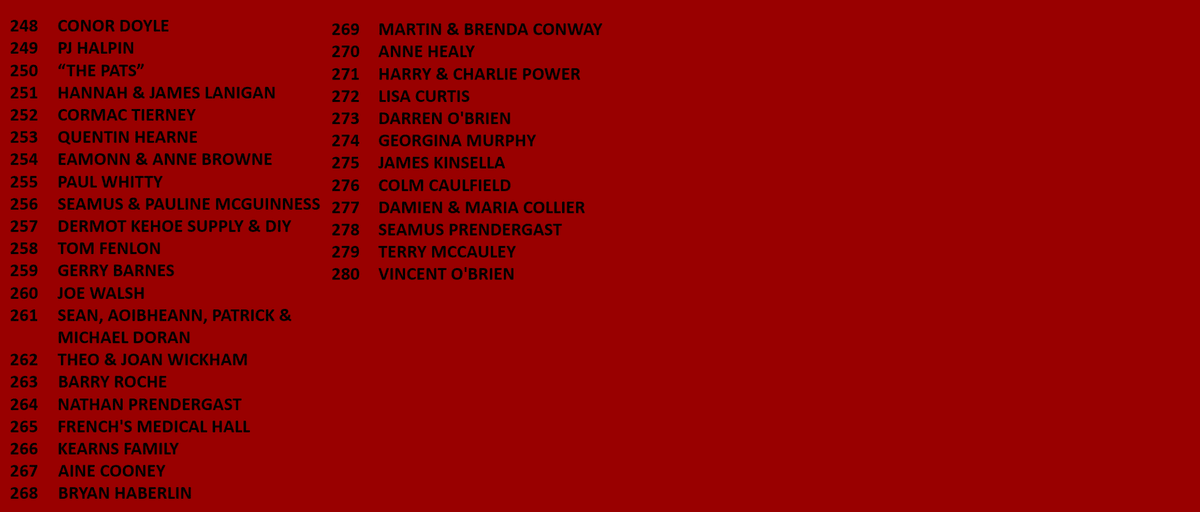

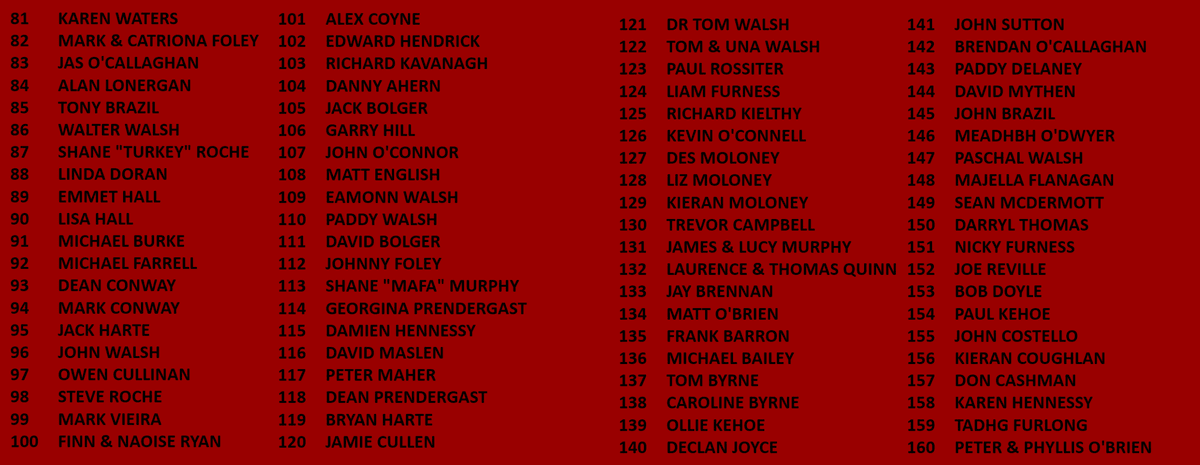

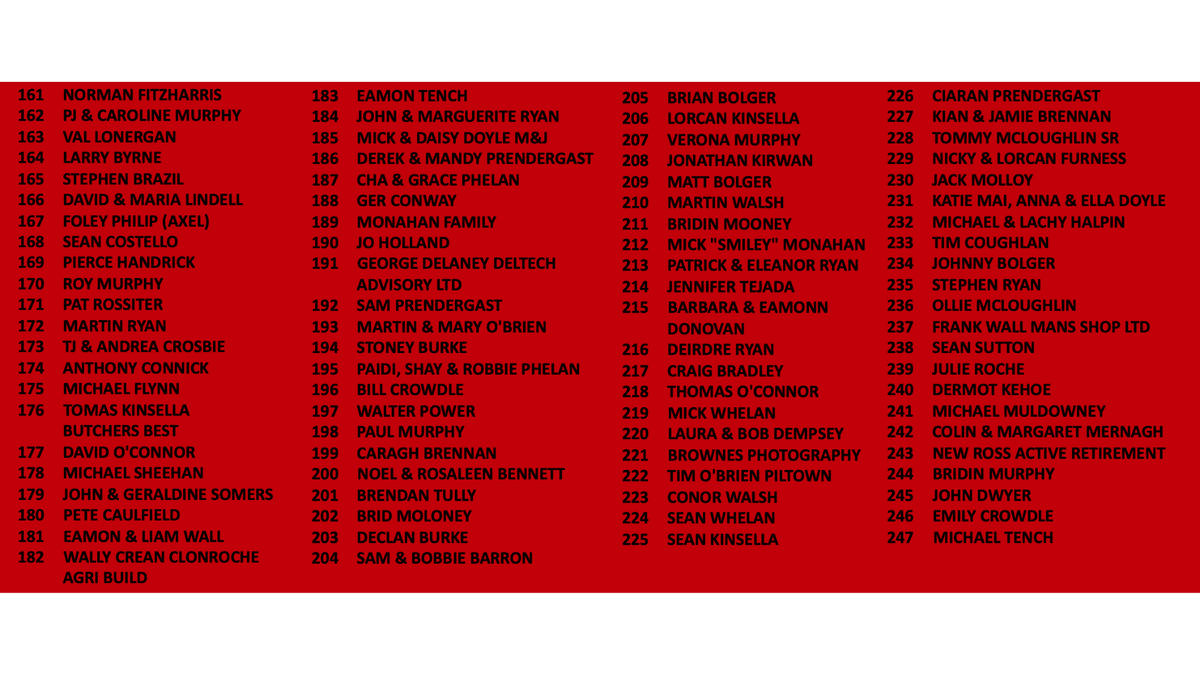

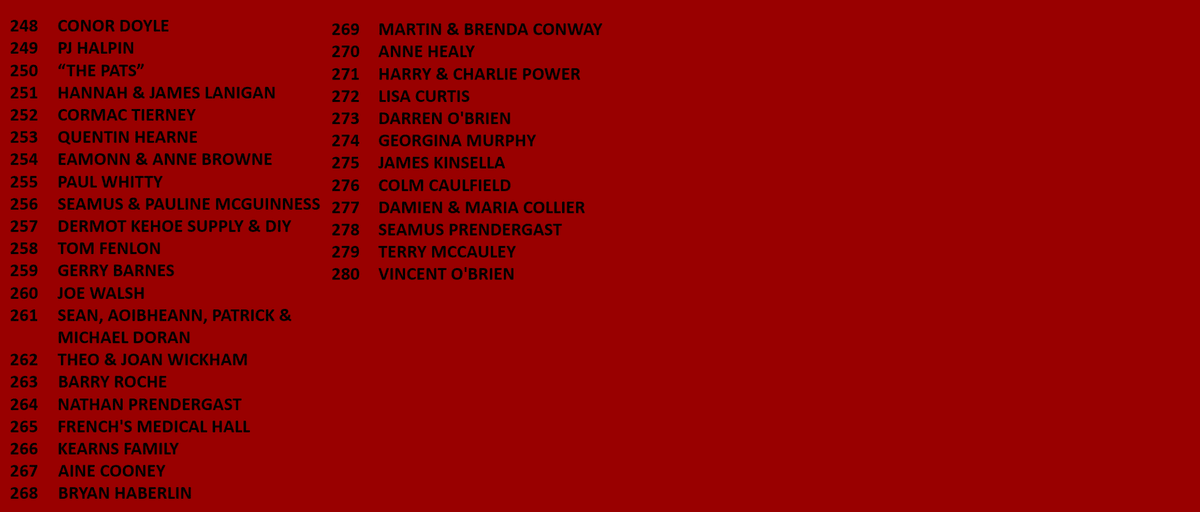

Legacy Wall

We want to write your name, in stone, to record the generous donation that you are making to the club.

That will stand as a long lasting record to recognise that you were part of the 300 Club that enabled this important development of the club.

Quarterly Draws

At the end of every quarter (quarter 1 ending in December 2024) we will hold a draw to give something back to 300 Club members.

This will include prizes of €1000, €300 and three x €100 Club Shop (Team Wear/Canterbury) vouchers.

IRFU YCYC Grand Prize Draw

Automatic entry to the annual IRFU Your Club Your Country Draw.

Prizes for 2024 include return flights, accommodation and match tickets for the British and Irish Lions in Australia and many more fantastic prizes.

Tax Relief on Contributions

The Department of Tourism, Culture, Arts, Gaeltacht, Sport and Media has formally approved this capital project as an Approved Project for Tax Relief Purposes (approved project number R-11-33-21 with G.S. Sports Exemption Number 5772). This means that tax relief is available on donations of at least €250 in a calendar year. The ability to claim this tax relief is vital to the success of the 300 Club.

PAYE Members

By providing your PPS number and completing form SPR1 (club will provide), the club can claim tax relief on your contribution.

For example, for a contribution of €360 from a PAYE member who pays standard rate tax at 20%, that contribution can be regarded as being 80% of the donation making the total donation equivalent to €450 which allows the club to claim an additional €90 in tax relief. For higher rate tax, the club can claim €240 in tax relief.

This is at no cost to the PAYE member.

This is only applicable if the PAYE member is not jointly assessed with a spouse or civil partner who pays tax under self-assessment.

Self-Assessment Tax Members

The club cannot claim tax relief on contributions from a self-assessed individual or company.

However the self assessed can claim the cost in full against their taxable income, thereby getting tax relief at their marginal rate.

Similarly for a self-assessed individual at the 40% tax rate, the individual can claim 40% tax relief thus resulting in a net cost to the individual of €600.

If you have any queries with regard to tax relief options, then please contact our Honorary Treasurer, John Hickey, at Ryan & Hickey Accountancy, 10 Priory Street, New Ross, phone 051 421702 or email johnhickey@rhaccounting.ie

Frequently Asked Questions

What is the 300 Club?

The 300 Club is a fundraising initiative organized by New Ross Rugby Club to support our purchase of new women’s dressing rooms, gym, and all-weather pitch. By making a contribution, you’re helping the club achieve these goals. As a gesture of appreciation, contributors are entered into quarterly draws where they may receive a token of our gratitude.

How will 300 Club funds be used?

Funds will be exclusively used for development purposes. This funding stream is managed separately from the funding used for ongoing operational costs of the club.

Does the 300 Club replace the club lotto?

No, the lotto will continue to contribute to the ongoing operational costs of the club. We appreciate whatever support people can give us, whether that is through the 300 Club or the lotto.

Do I have to be a member of the rugby club to participate?

No, the 300 club is open anybody aged 18 or over.

How do I make a contribution?

Either online, monthly using the ClubForce link above or by contacting our 300 Club manager, Tommy McLoughlin on 300@nrrfc.ie to make and electronic fund transfer or cash payment.

How do I stop a monthly contribution?

In the unfortunate event that you wish to stop a monthly contribution, please contact our 300 Club manager, Tommy McLoughlin on 300@nrrfc.ie

Can I get a refund if I change my mind?

No, all contributions are final.

How is my personal data protected?

Your personal data collected during the contribution process will be used solely for administering the 300 Club. We are committed to protecting your privacy and will handle your data in accordance with applicable data protection laws.

Why am I redirected to a ClubForce site for monthly membership signup?

To simplify management of both payments and GDPR compliance, we use ClubForce’s existing capability for that functionality.

What if the card that I use for monthly payments expires or its details needs to be changed?

The ClubForce site will email you if the your card is about to expire and will allow you to update card details.

Do I need to be a tax payer to participate?

No, but there is benefit to the club if you are.

How does tax relief work if I am a PAYE worker?

If you are taxed at the 20% tax rate then your donation is regarded as being 80% of the total donation and the club can claim the other 20% back at no cost to you, i.e. if you pay €30/month for a 12 months then that's a total of €360, the club can then claim back another €90 (€90 being 20% of the total of €450). If you are taxed at 40% then we can claim back €240.

What do I need to do for tax relief if I am a PAYE worker?

When you sign on for the monthly payment (or when you make a lump sum payment) then please provide us with your PPS number. At the end of the calendar year we will email/give you a SPR1 Cert with certain details filled in and the remaining to be filled in by you and sent back to us (to 300@nrrfc.ie). We then keep those forms on record as part of our application to claim the tax benefit. We will help you at every stage of this process. Please do not hestitate to contact us for any help that you might need. There is no cost to you, for the club to be able to claim this tax relief back from the government.

How does tax relief work if I do a self-assessed tax return?

If you individually or jointly pay tax under the self-assessment scheme then you can claim the cost in full against your taxable income, thereby getting tax relief at your marginal rate. When you make your contribution, the club will issue a receipt for your records.

How does tax relief work if I contribute from a limited company?

Any contribution from a limited company can be treated as being a trading expense.

How often are draws held?

Draws are held every quarter starting from the end of the first quarter which will be in the last week of December 2024. The draws will be held in conjunction with other events such as the Christmas Raffle or Lotto and will be overseen in the same way.

What if I have another question?

Please email us at 300@nrrfc.ie and we'll respond as soon as possible.

New Ross Rugby Football Club © 2024